Best PGDM Colleges in Bangalore | Top 10 PGDM Colleges in Bangalore

Blog

Impact of Carry Trade Turmoil on Global Markets

A small fire turned into big smoke, whereas Japan ignited the fire, but the US tech index released smoke. Let’s delve into this exciting arbitrage story.

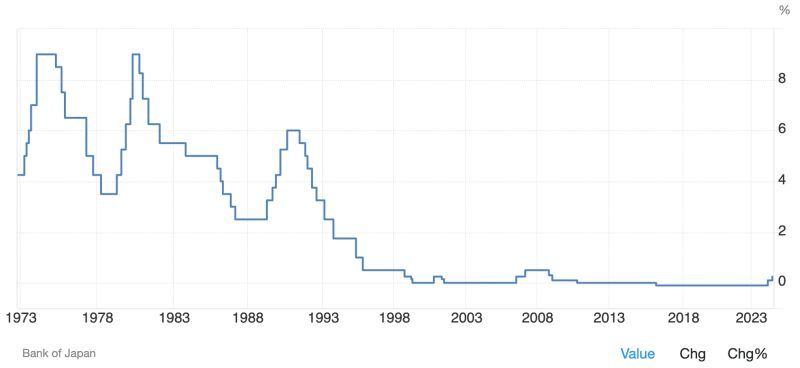

Before in deep of the story, let’s us understand the carry trade, this concept is nothing but taking loan from bank/institution for lower interest and investing in high interest generating assets that could be a bonds/security. This practice is very popular in Japan, where domestic institutions take loan in Japan as their interest are flattish & lowest of 0% from last 3 decades & invest in other countries most often in united states.

Japanese institutions & hedge funds follow a widespread practice called carry trade, where they take a loan in Japan and spread that across the globe, mainly on US tech. The catch is that the loan is interest-free as the Japan central bank has maintained very flattish interest rates since 1997; the highest rate since 1997 is 0.5% and went negative for eight years at -0.1% in 2016.

Why did this trigger a global market fall?

This rate hike indicates that the central bank is hawkish on interest rates, which will affect the loans borrowed in Japan as the cost of loans goes up. USDYEN* value appreciated from 165 to 144, so exchange cost will go up significantly, this uncertainty triggered a significant fall in US tech index as it attracted massive influx through carry trade. But other markets also witnessed a moderate fall as global markets were deeply integrated with macro developments.

What triggers Japan market (Nikkei 225) to fall 14%?

Markets never accept the hawkish policy from central banks as this will dilute the liquidity in the economy, and as part of that, it witnessed a huge fall.

What would be the impact on global markets & India?

This impact will continue in markets that have attracted massive inflows from Japan, such as US tech stocks. And Indian markets won’t have much impact as India has not received any huge inflows through carry trade, even if any carry investments go away in India. Currently, domestic investors are fluxing massive liquidity to absorb the selling capacity, so there is nothing to worry about for Indian markets.

*USDYEN: The currency pair combining the dollar of the United States of America (symbol $, code USD), and the Japanese yen of Japan (symbol ¥, code JPY).

Written by:

Reddyvari Jayavardhan Reddy

I Year PGDM Student of ABBS School of Management

Written by:

Kintada Vinay

I Year PGDM Student of ABBS School of Management

Mentored by:

Dr.Kamini Dhruva

Professor, ABBS School of Management